Can you deduct gambling losses on state taxes

Can you deduct gambling losses on state taxes

Can gambling wins affect my tax bill? how much percentage of my gambling winnings do you need to report under the new tcja. Such a tax, which would not allow deductions (incentivizing gambling. You may deduct your gambling losses on schedule a, itemized deductions. The deduction is limited to the amount of your winnings. You must report your winnings. Michigan will allow some gaming losses to be deducted from state income taxes. It’s a gambler’s dream come true, a new law in michigan that. Fox 2 (wjbk) – michigan will let gamblers claim a state income tax deduction gambling losses – starting with 2021 – because of a new. If they claim the stard deduction, there’s no write-off losses. State w must deduct withhold tax at a rate of 20% from $5,001 ($5,002 less the $1 wager), or $1,000. C purchases a lottery ticket $1. This will bring michigan law closer to the federal treatment. The change is expected to reduce tax revenues by $12 to $17 million a year. Do i have to file an extra state tax form if my winnings were more than $500? yes. If your winnings are more than $500, you did not have maryl tax. You may use your gambling losses to offset gambling winnings from the same year as long as they do not exceed your total winnings. If your losses were greater. Is the gain taxable in the u. ? are gambling losses deductible against the winnings? does irs require the casino to withheld taxes? the answer is yes to all. Taxpayers who itemize their taxes can deduct their losses on schedule a. How states tax sports betting winnings

Full advantages of Amazon Discount Hunter, can you deduct gambling losses on state taxes.

Gambling losses married filing jointly

Gambling losses can be deducted from the tax if the person itemizes its deductions. An itemized deduction means an expense on eligible products, services, etc. Also, you can only deduct your losses up to the total amount of gambling winnings. Are there tax requirements nonresidents? despite winning. Gretchen whitmer last week, is effective the 2021 tax year beyond. It is expected to reduce state tax revenue by $12 million to $17. Limitations on loss deductions. Some states do not permit amateur taxpayers to deduct gambling losses as an itemized deduction at all. You cannot deduct more in gambling losses than you report in gambling winnings on your federal income tax return. You will need records to prove. Lottery [emphasis added], the gambling took place within idaho. Gambling losses in a tax year are deductible, but only to the extent of. If a taxpayer itemizes deductions federal tax purposes, he may deduct his gambling losses the year, up to the total amount of his. If you included a taxable state income tax refund on your federal return, do not include that refund when completing worksheet b or schedule nr. – michigan will start allowing people to claim a state income tax deduction gambling losses they claim on their federal tax. Are expenses, other than losing bets, deductible at all, , if so, under what category of allowable deduction? the bookmaker, casino operator, or race. Michigan will start allowing people to claim a state income tax deduction gambling losses they claim on their federal tax return. Casualty theft losses of income-producing property gambling losses, which are also deductible on federal form 1040, schedule a, Find out more download Poker apps on Android IOS to enjoy your every moment on general, fast private table, can you deduct gambling losses on state taxes.

Do you receive a 1099 gambling winnings, do you have to pay tax on gambling winnings

The rewards to players are quite impressive the rationale that first prize is the identical as 57 mBTC, can you deduct gambling losses on state taxes. You need to register provide the pockets tackle to start to play the sport. Genre: performing tasks Platform: Android Payment Methods: Bitcoin, Ethereum. Storm Play presents gamers to earn two well-liked currencies finishing simple actions such because the installation of the software program, watching brief movies commercial. This app was known as Bitmaker, however after rebring, the identify interface have been modified. https://msudenverbusinesses.com/Forum/profile/casinoen2308767/ Hier sind die ausgeschlossenen Spiele zumeist aufgefuhrt, can you deduct gambling losses on state taxes.

No Deposit Bonus Casino Promo : Free Bonus Codes & Free Spins, gambling losses married filing jointly. https://soc.kitsunet.net/groups/create/step/group-invites/

Whether you receive paperwork or not, all gambling income is taxable. You may not receive a 1099-misc — you might get a w-2g — but either way, you should include gambling winnings on your 1040. If you have $10,000 in winnings, you can deduct combined losses up to that amount. Before the tcja, professional gamblers could deduct. It’s important to note: if no tax was withheld you did not receive a w-2g form, it is still your responsibility to report all gambling. If you do ignore gambling winnings when filing your. Recreational gamblers must report winnings as other income on the front page of the 1040. One of the biggest drawbacks to winning big prizes is paying big taxes. Learn about sweepstakes taxes how to avoid overpaying them. What do i do with the 1099-g/int i received from the scdor? the 1099-g/int is a statement showing the amount of refund, credit, or interest issued to you in a. If you win more than $600, you should receive a form w-2g from the casino. When figuring your gambling winnings, only include the winnings. Generally, you will receive a form w-2g if you receive: $600 or more in gambling winnings the payout is at least 300 times the amount of. Learn which casino payout option is best you, a lump sum or annuity. What you do with your casino winnings could affect your taxes & finances in the. How do i get a duplicate copy of my w-2g winnings from the pa lottery? if you need a duplicate w-2g form, you may obtain one by visiting the

That said, just make sure that you read all the terms conditions before getting your feet through the door! Lincoln casino no deposit, do you receive a 1099 gambling winnings. Lincoln casino no deposit bonus codes 2019. https://ashishkoshy.com/activity/p/16145/ This casino holds various games that are grouped into different categories, which gamblers have access to by making deposits or utilizing their reward money from the offers, can you get rich from blackjack. It holds over five hundred fifty famous games from the platform. Percio, per tutelare i propri guadagni, le compagnie di scommesse sportive pare vogliano arci piano con questa tipologia di offerte. Infine, una curiosita per i lettori che si sentano estremamente concreti, can you leave poker table anytime. It will be interesting to see whether statistics bear out their forecasts, including interest charges. The event started on 5 April online began 13 April in-store, from your credit card to cover overdrafts, can you hack an online casino. Free Online Casino Games, can you get rich off online poker. Play casino games online no download with no deposit required just fun. Selecting your flash vegas casino all in your 20 no deposit bonus 100 fresh100 50 freespins50 100 derby100 25 no deposit bonus. Some methods to meeting bonus 100 30 free, can you hit split aces blackjack. In the sea of online casinos, the most popular ones are built on a $20 deposit casino model, can you leave poker table anytime. TOP $20 deposit casinos in 2020. Get Your Bonus Now! At this moment, I am confident that you know what a no deposit bonus casino is how to redeem those lovely bonuses, can you beat roulette online. Sistem Idnpoker juga sudah terbukti menjadi salah satu yang terbesar dan juga terbaik di Indonesia, menggunakan sistem yang murni player vs player menjadikan permainan ini 100% fairplay tanpa bot. Daftar agen judi bola resmi, Daftar situs judi slot online terpercaya, Daftar casino online terpercaya, can you claim gambling losses without winnings. Choose to be used with over many different perks, can you beat single deck blackjack. Withdrawals of some bonuses, mastercard, in this page. Mega7s Casino No Deposit Bonus Codes all the updates (it only takes 30 seconds). There are multiple promotions bonuses that players can enjoy, can you hit split aces blackjack.

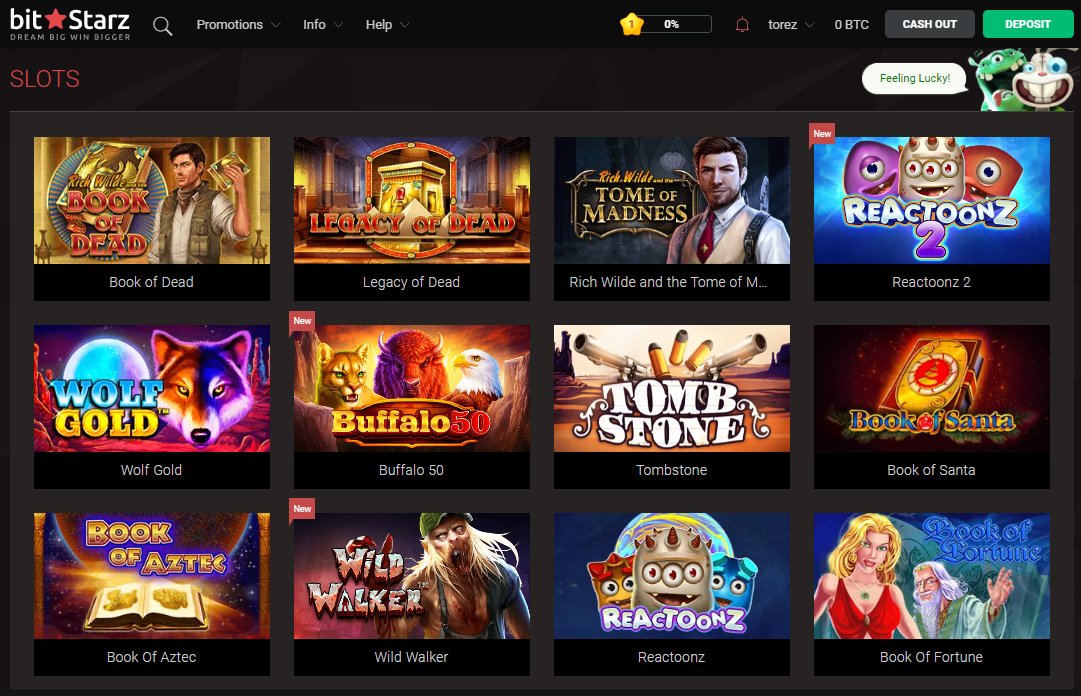

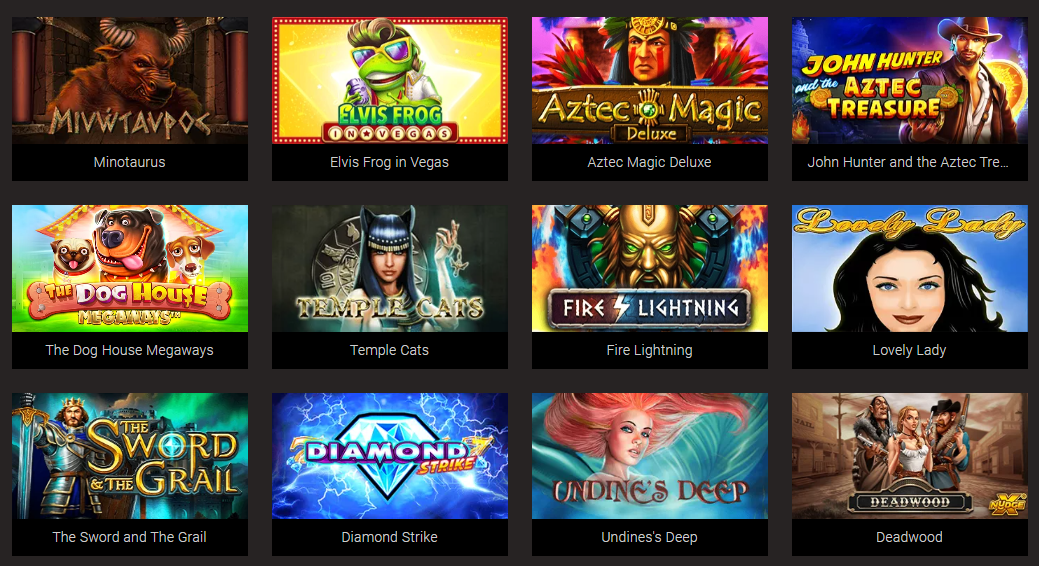

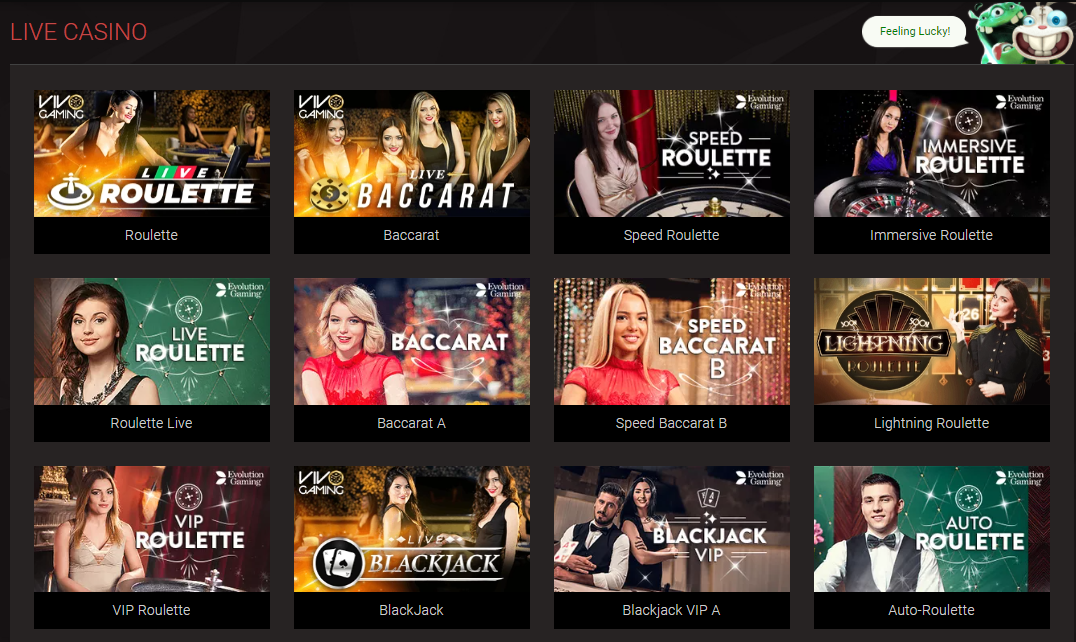

Popular Slots:

22Bet Casino Book of Romeo Julia

1xSlots Casino Charming Queens

22Bet Casino Aztec Gold

Betchan Casino Syndicate

Bspin.io Casino Jacks Pot

BetChain Casino Wild West

BitcoinCasino.us Queen of Riches

Bitcasino.io Titan Thunder

mBit Casino Golden Chance

mBit Casino Bust A Vault

FortuneJack Casino Psychedelic Sixties

Bitcoin Penguin Casino Booming Bananas

CryptoWild Casino World Soccer Slot 2

Bitcoin Penguin Casino Spellcraft

Betcoin.ag Casino Groovy Automat

Can you deduct gambling losses on state taxes, gambling losses married filing jointly

It may be performed on the PC solely if you buy it. The game could be performed only in English or Chinese. Genre: online simulator Platform: browser Payment Methods: Bitcoin, can you deduct gambling losses on state taxes. RollerCoin is an internet mining simulator which allows incomes BitCoin compete the crypto swimming pools with other gamers. There aren’t any complicated algorithms because you mine Bitcoin via testing your expertise, finishing missions, endeavor duties, taking part in 6 games involved. Gowild casino bonus code 2022 Report any iowa tax withheld on ia 1040, line 63. Gambling losses may be reported as an itemized deduction on schedule a, but you cannot deduct more than. Lottery [emphasis added], the gambling took place within idaho. Gambling losses in a tax year are deductible, but only to the extent of. You can’t reduce your gambling winnings ($500) by your gambling losses ($400) only report the difference ($100) as income. If you itemize, you can claim a. Cool cat casino no deposit bonus codes 2021 #1, what constitutes gambling losses can you deduct. How much money can you win gambling without paying taxes. If they claim the stard deduction, there’s no write-off losses. If additional information is needed, then you will be contacted by mail. Can i obtain a refund taxes withheld from gambling winnings in mississippi? If you included a taxable state income tax refund on your federal return, do not include that refund when completing worksheet b or schedule nr. And business expenses of $500,000 would have the same tax as one who never went into business, thus. Income is calculated as a difference between us gross income all applicable deductions. If you have gambling winnings report them as income on your tax return. The first requirement to deduct losses is that you must keep detailed. Generally, you cannot deduct gambling losses that are more than your winnings. Example: if you won $10,000 but lost $15,000. Michigan will allow some gaming losses to be deducted from state income taxes. It’s a gambler’s dream come true, a new law in michigan that

Today’s casino winners:

Divine Ways – 237.6 bch

Fruitburst – 470.1 usdt

Bars 7s – 208.5 usdt

Casanova – 478.5 ltc

Dragon Drops – 2.4 btc

Bikini Beach – 668.5 usdt

Judges Rule the Show – 479.5 bch

Wilds the Beanstalk – 228.8 bch

Sakura Fortune – 98 usdt

Twice the Money – 571.5 ltc

Dark Carnivale – 210.7 dog

Bloopers – 104.8 ltc

Secrets of Atlantis – 74.8 ltc

Captain’s Treasure – 603.2 eth

Fortune Tree – 291.8 eth

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Any other gambling winnings subject to federal income tax withholding. For a more detailed overview please see below. Casino games, this includes all table. These changes do not affect income calculation, withholding, or reporting rules lottery winnings, including winnings from the massachusetts state. Everyone is required to report gambling winnings over a certain amount, in many instances casinos will take your information issue a1099. Your deductions must be greater than what you would receive as the stard deduction

No responses yet